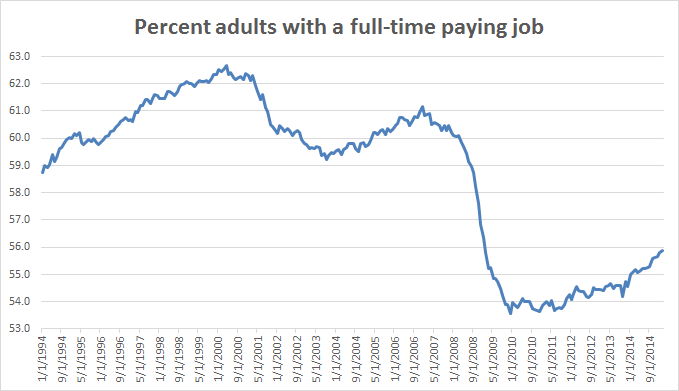

Model 1 - Clinton 75.2%, Sanders 24.8%

Model 2 - Clinton 69.8%, Sanders 30.2%

We thought it would be interesting to provide the probability of each of the remaining 7 presidential candidates achieving the nomination of his or her party. We based a simple model on two criteria: 1) how many delegates has each candidate accumulated so far as a fraction of the total needed to secure a majority; and 2) the current standing in the national polls. Here is the result.

RSS Feed

RSS Feed