Real GDP per capita is one of the key ingredients of the Switkay USA Economic Vitality Index, posted at the end of each quarter, using the final numbers for the previous quarter. While most politicians prefer to focus on raw GDP numbers, these must be adjusted both for the increase in prices (real) and the increase in population (per capita), to get a sense of overall well-being, in just the same way that unemployment rates must be adjusted for part-timers who need full-time work (U6) and the labor force participation rate.

|

A friend asked me about a recent blog post of mine (see below) discussing real GDP per capita. He found the graph a bit hard to read. Above, I have created a new graph in which we see percent change in real GDP per capita for each year over the previous year, 1948-2014, shown with individual bars (green for increase, red for decrease). The wavy curve smooths this data still further into a trailing 4-year moving average, corresponding to the length of a presidential term. For comparison, the median annual percent change in real GDP per capita from 1948-2014 is +2.2%.

Real GDP per capita is one of the key ingredients of the Switkay USA Economic Vitality Index, posted at the end of each quarter, using the final numbers for the previous quarter. While most politicians prefer to focus on raw GDP numbers, these must be adjusted both for the increase in prices (real) and the increase in population (per capita), to get a sense of overall well-being, in just the same way that unemployment rates must be adjusted for part-timers who need full-time work (U6) and the labor force participation rate.

0 Comments

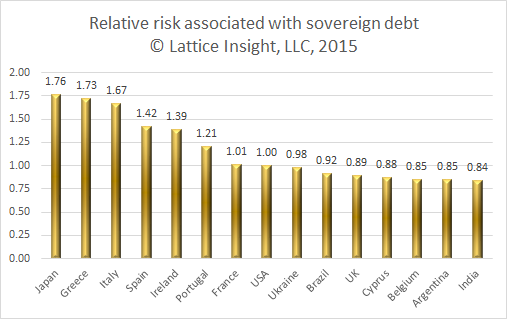

As we await the turmoil in global markets subsequent to the Greek debt bailout referendum, I thought it would be interesting to compare the danger of a default by Greece to that of other countries. What danger do other countries' debts pose to the global financial system?

The model I created makes use of the following variables: 1) credit ratings by Standard & Poor's, Moody's, and Fitch; 2) public debt as a fraction of GDP; 3) total external debt. 1) quantifies the risk of default; 2) quantifies the debt ratio; 3) quantifies the magnitude of external debt. The results are scaled so that the United States of America has a value of 1.00. The results imply that we should be as concerned about Japan and Italy as much as we are about Greece, with Spain, Ireland, and Portugal not far behind. Although these countries have better credit ratings than Greece, the magnitude of debt involved is much larger, and particularly in the case of Japan, the debt ratio is enormous: about 2.32, far higher than Greece's 1.75. |

AuthorHal M. Switkay, Ph.D. is a professional mathematician and statistician. Archives

December 2020

Categories

|

RSS Feed

RSS Feed