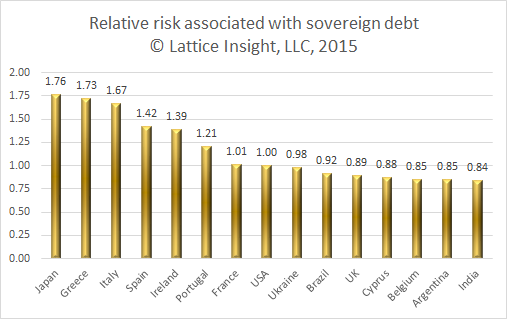

As we await the turmoil in global markets subsequent to the Greek debt bailout referendum, I thought it would be interesting to compare the danger of a default by Greece to that of other countries. What danger do other countries' debts pose to the global financial system?

The model I created makes use of the following variables: 1) credit ratings by Standard & Poor's, Moody's, and Fitch; 2) public debt as a fraction of GDP; 3) total external debt. 1) quantifies the risk of default; 2) quantifies the debt ratio; 3) quantifies the magnitude of external debt. The results are scaled so that the United States of America has a value of 1.00.

The results imply that we should be as concerned about Japan and Italy as much as we are about Greece, with Spain, Ireland, and Portugal not far behind. Although these countries have better credit ratings than Greece, the magnitude of debt involved is much larger, and particularly in the case of Japan, the debt ratio is enormous: about 2.32, far higher than Greece's 1.75.

The model I created makes use of the following variables: 1) credit ratings by Standard & Poor's, Moody's, and Fitch; 2) public debt as a fraction of GDP; 3) total external debt. 1) quantifies the risk of default; 2) quantifies the debt ratio; 3) quantifies the magnitude of external debt. The results are scaled so that the United States of America has a value of 1.00.

The results imply that we should be as concerned about Japan and Italy as much as we are about Greece, with Spain, Ireland, and Portugal not far behind. Although these countries have better credit ratings than Greece, the magnitude of debt involved is much larger, and particularly in the case of Japan, the debt ratio is enormous: about 2.32, far higher than Greece's 1.75.

RSS Feed

RSS Feed